A Family’s Guide To Thriving on a Single Income

I never thought we would go from a dual income to a single-income household when we had kids. It felt scary, with every decision now magnified under the lens of our new financial reality.

As an Amazon Associate I earn from qualifying purchases. This post may contain affiliate links which means I make a small commission at no extra cost to you. See my full disclosure here.

Honestly, my husband and I never even sat down to crunch the numbers and see how difficult it was going to be. We were young and if I am being completely honest, we were totally flying by the seat of our pants with our finances.

But as the days got closer for me to go back to work from maternity leave after our first child was born, I knew I wasn’t going to be able to leave my baby with someone else. Let alone afford the child care costs. I worked at a daycare before I got married so I knew how expensive that was going to be.

We had no plan, only determination and a healthy dose of naivety.

Let me walk you through a few things we have done through the years as a now family of five to be able to live on one income for the last 20 years and counting.

Dave Ramsey To The Rescue

The first step we took toward living on one income was reading The Total Money Makeover by Dave Ramsey.

I knew if we wanted to make it work, we needed a clear, practical plan for managing our finances. Ramsey’s seven baby steps gave us that direction: from saving a starter emergency fund to paying off all debt, building a larger emergency fund, and investing.

At first, I was the one leading the charge. I had to take control of our budget, make spending cuts, and stick to the steps on my own until my husband got on board.

It wasn’t easy, but once we both started following Ramsey’s plan together, things really began to turn around.

Getting Rid Of High-Interest Debt….All Debt Really!

I’ll admit, tackling high-interest credit card debt seemed impossible at first. It ate at me, knowing part of our family’s income disappeared into a black hole of interest rates and fees every month. I knew we had to tackle this debt first to stand a chance at financial breathing room on our single income.

Checking our bank accounts became a daily ritual. I targeted the credit cards with the highest interest rates, throwing any extra cash we had, like tax returns or a bonus, or money from a side hustle, directly at these debts.

It wasn’t just about paying the minimum; it was about getting the principal down. Every extra dollar thrown at these debts meant less money wasted on interest, getting us closer to a life where our income served us, not the credit card companies.

The joy of scratching each card off our list was a high for me. With careful planning and a few lifestyle adjustments, we not only freed ourselves from credit cards and car payments debt, but also paved the way for building a healthy savings account.

It’s a journey I’d recommend to anyone feeling the weight of debt in a one-income household.

Building an Emergency Fund

I learned the hard way that unexpected expenses come when you least expect them. Major car repairs seemed to always be something we had to deal with in the early years of marriage, and it was the emergency fund that became our saving grace.

Saving for the unknown seemed daunting at first, with a single income stretched across endless needs. Yet, setting up an emergency fund was the cushion that got us through many times.

For the first little bit all we could save was $1,000 like Dave Ramsey recommends. It wasn’t until after we got ourselves out of debt that we grew our savings covering three to six months’ worth of expenses.

Reaching this goal gave me so much peace of mind, allowing us to focus on other financial goals.

Life became less intimidating, knowing we had a safety net.

Every month, a portion of our income went directly into a savings account, growing steadily. This practice wasn’t just about security; it was a step towards financial independence.

An emergency fund is not just a good idea; it’s essential for weathering life’s storms on a single income.

Reducing Monthly Bills

I studied our monthly expenses with a fine tooth comb. We never had gym memberships but you better belive those kinds of extra expenses were the first to go. The high-end cable package was next; we only enjoyed less than a quarter of those channels anyway.

Switching these to lower-cost, essential services helped us put more money back into our bank account. What started as a challenge became a rewarding search to cut out every possible non-essential expense.

Almost for every monthly bill, I called and tried to negotiate a better price.

Were these impulse buys going to boost our family’s income or drain it? Did we need every premium channel or could basic packages suffice?

Remember when Netflix used to be a mail dvd rental service? I believe the basic plan started at $4.99 and that’s what we switched to from our pricey cable service.

These questions helped us take clear steps in the right direction, cutting costs without sacrificing quality of life. The extra cash we found not only relieved pressure but helped us get closer to our financial goals.

Adjusting our lifestyle proved less scary than expected. Living with less opened doors to a more focused financial situation.

Grocery Budget Overhaul

I needed to rethink how I was doing grocery shopping. My first move was a deep dive into our past month’s grocery expenses. I began planning meals around sales and what was already in our pantry. This change, though simple, made a big difference.

Next, I tackled impulse buys head-on. Sticking to the list became my goal. It was tough at first, given our previous grocery trips included several off-list purchases. Especially if my husband and kids came along. Yet, the discipline paid off. We saw our monthly grocery expenses get lower, freeing up much-needed cash for our emergency fund.

The last eight years or so, I discovered bulk buying for non-perishables through Azure Standard or case lot sales and using cash-back apps. Both strategies have become an important part in stretching our grocery budget further.

Side Hustles For The Stay-at-home Parent

Side hustles served as a bridge for us, turning our financial goals from dreams into realities. They helped not just to our monthly income but also provided a buffer for surprise expenses and allowed us to send more into our savings account, emergency fund, and even investment accounts.

The great thing about getting a side gig was the sense of empowerment it gave us over our finances, opening other paths for extra income that diversified our single source of income.

The side hustles or part-time jobs I had over the years were simple. I’ve been a babysitter, a dog walker, a sales associate for the holidays, an online survey taker, a pooper scooper, house cleaner, and I’m sure other things I can’t remember right now.

It might just be the perfect strategy for other one-income families going through similar financial situations.

Smart Ways to Save

I’ve learned that every penny counts and that smart savings habits can transform a financial situation, especially on a single income.

Taking control of our daily finances wasn’t just about cutting costs; it involved out of the box ideas too.

Automatic transfers to a savings accounts became my silent partners in building emergency funds. Setting this up made sure that a portion of our household income was immediately moved to our savings account, almost without us noticing.

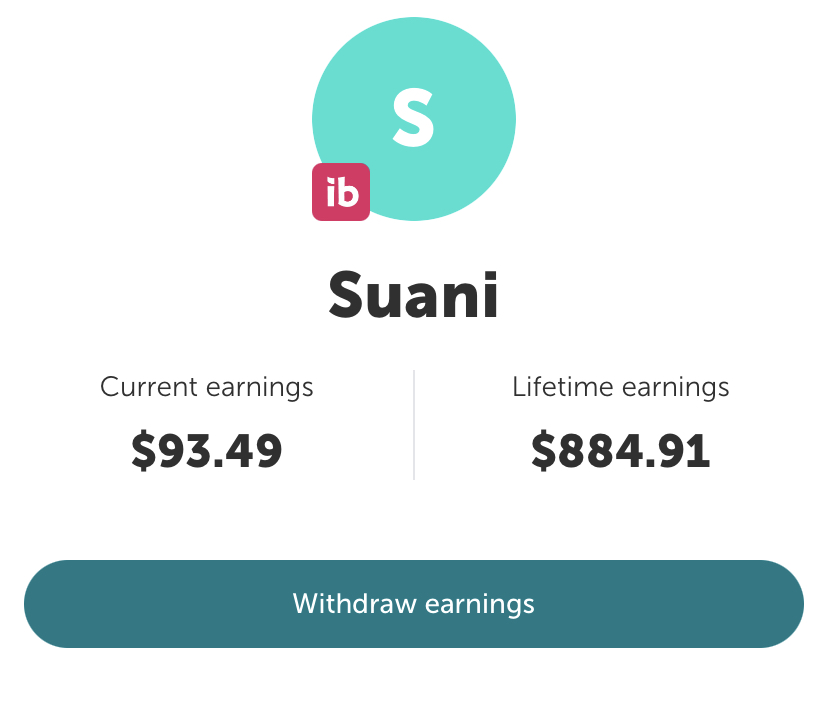

Another big help was discovering cash-back apps. Ibotta and Fetch are two of my favorites.

These apps let us earn some money back on things we were already buying, like groceries or household items.

Instead of missing out, I made it a habit to check the apps before any grocery store shopping trip. Even doing online shopping through Rakuten first, was a great way to earn cash back.

This turned our regular expenses into a little extra cash, which added up over time. Watching our savings grow made living on one income feel less overwhelming, giving us a safety net for any surprise costs.

Making A Major Lifestyle Change Like Downsizing

When moving to a one-income lifestyle, you might need to think about downsizing, like getting a smaller home or a more affordable car. It’s not always easy to let go of things, but simplifying your expenses can make a big difference.

A smaller home means lower mortgage or rent payments, cheaper utility bills, and sometimes even lower property taxes.

Trading in a pricey car for something more affordable, or even getting by with one car, can also free up cash for other needs, savings, or future goals. At first, these changes may feel like sacrifices, but they often bring more peace of mind and flexibility in your budget.

Sometimes, having less really does give you more – more breathing room financially and more time to focus on what truly matters.

Investing In Your Future

Thanks to my husband and Dave Ramsey I learned early on that planning for our long-term financial future wasn’t just an option; it was a necessity, especially on a single income.

Retirement savings once felt daunting, but with careful planning and a bit of sacrifice, with my husbands help I saw that financial security was within reach.

While I focused on managing our household budget, my husband took on the role of researching and investing in mutual funds, making sure we had a plan in place for our future. Working with a financial advisor was helpful, helping us better understand our options and set realistic financial goals.

Setting up automatic deposits into our retirement accounts was a big step forward. Even a small amount of your monthly income will make a difference over time. To make this possible, you might need to make some lifestyle changes, like cutting back on non-essential expenses.

Every step we took brought us closer to financial freedom—not just to make ends meet but to create a secure future for ourselves and our children. Investing for our family’s future has been one of the best decisions we’ve made for our one-income household.

How To Live On One Income: Save It For Later!

How To Live On One Income

If your goal is to live on one income, whether it’s so you can be a stay-at-home mom, due to a job loss, or just a desire to simplify, know that it’s possible, even in today’s economy.

It takes careful planning, some sacrifices, and commitment, but if this is truly important to you, you can make it work.

With budgeting, cutting out unnecessary expenses, and even finding small ways to save or earn extra cash, you’ll see that one income can cover what you need.

Remember, you’re not just making ends meet; you’re building a life that reflects your values and goals.

It may be challenging at times, but the freedom and security that come from managing well on one income are well worth the effort.